BFD has an interesting discussion on losing insurance coverage: Insurance Resources — Fire Safe Berkeley

The process they recommend:

- Contact your current insurance company to ask about possible improvements

- Ask for and understand your risk score

- Mitigate your risk score if you can

- If all fails, look for a new insurance carrier. BFD recommends using a local independent agent with good local knowledge

Here are some additional notes to the process above:

- consider filing a complain with the CA Dept of Insurance if you believe that your non-renewal was not justified. Some homeowners have reported been successful with this tactic. This is particularly true in cases when the homeowner has implemented recent mitigations at the request of the insurance company, but also in other cases.

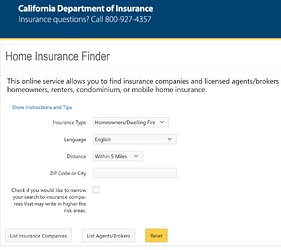

- When you look for another carrier, consider looking for a new carrier that write policies in very high fire danger areas with this insurance finder page from the CA Dept of Insurance. Unfortunately, many of us who have had to look for new carriers after being canceled in the last few years have been unsuccessful—the CA Fair Plan has very often been the only choice.

source: CA Dept of Insurance

If you are left with the last recourse of the [CA Fair Plan] be aware that it only covers some risks, and that, in order to be fully covered as you would be with a regular homeowner’s insurance policy, you need an additional insurance called Differences in Conditions (DIC). The CDI publishes a list of current providers of DIC.(https://www.cfpnet.com/)