TLDR: IBHS, the insurance company consortium, requires, in the lowest certification level, both strict Zone 0 and basic home hardening measures.

It stands to reason that the insurance industry wants you to take the most efficient measures to resist wildfire. After all, their interest is to get you to pay the premiums every year without having to ever reimburse a claim. What does the insurance company want you to do?

IBHS is a consortium of insurance companies gathering the issuers of 76% of homeowners’ policies in the US. They have been funding, for the last 30 years, much of the research on wildfire science. Around 2011, they started proposing model regulations requiring strict Zone 0 compliance. Around 2023, they came out with a program specific to CA that allows homeowners to qualify for a certification program with two levels:

-

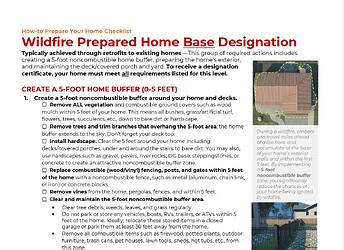

Base, which requires

- full and strict Zone 0

- cleared roofs, and replacement of wood roofs by class-A roofs

- replacement of plastic with metal gutters

- ember-resistant vents

- 6" non-combustible clearance at the bottom of walls

- full and strict Zone 1 compliance

-

Plus is much more difficult to obtain

- enclosed eaves

- screened gutters

- dual pane, dual tempered windows and doors

- non-combustible siding

- retrofit decks with solid (no gap) non-combustible walking surface

It appears to be a matter of time before member insurance companies require us to actually obtain Base level certification before renewing our homeowners insurance policies.

Download IBHS’s self-inspection checklist: